A Beginner’s Guide to Osmosis Crypto: What It Is and How It Works

Introduction

Cryptocurrencies have revolutionized the world of finance, providing investors with a decentralized and secure way to store and trade value. With the rise of DeFi (decentralized finance) platforms, investors can enjoy even more freedom and flexibility in managing their financial assets.

One of the biggest DeFi ecosystems right now is the Cosmos network. More than 50 blockchains, called zones, are already live based on the Cosmos SDK, and the number is still growing. Within Cosmos, Osmosis is the biggest decentralized exchange in the Cosmos ecosystem that enables cross-chain transactions through Inter-Blockchain Communication (IBC).

In this beginner’s guide, we will explore what Osmosis Crypto is, how it works, and why it is significant in the world of cryptocurrency. Therefore we will cover the following chapters:

- What is Osmosis Crypto and How Does It Work?

- Overview of Osmosis Crypto and its Features

- Getting Started with Osmosis Crypto

- Using Osmosis Crypto for Trading and Staking

- Maximizing Your Rewards from Osmosis Crypto

What is Osmosis Crypto and How Does It Work?

Osmosis Crypto – the “Interchain Liquidity Lab” – is a decentralized exchange (DEX) built on the Cosmos blockchain. It enables investors to trade and stake their cryptocurrencies without a central authority. Osmosis uses an automated market maker (AMM) algorithm that automatically adjusts the price of assets in a liquidity pool based on supply and demand. This ensures traders can always buy and sell their assets at fair market prices.

As Osmosis leverages the power of the Cosmos blockchain to facilitate communication and composability between various tokens from different blockchains, it can handle trades between any of the 50 distinct blockchains within the Cosmos ecosystem, all within the same decentralized exchange (DEX) protocol. This opens up a new world of possibilities for traders and developers, allowing them to swap assets easily and build decentralized applications seamlessly interacting with different blockchains.

The Osmosis DEX offers a user-friendly front-end for DeFi traders.

The Osmosis DEX offers a user-friendly front-end for DeFi traders.

The native token of Osmosis is OSMO. It is used in all trading pairs on the platform, which makes it the central exchange unit on Osmosis. At the time of writing, the price of OSMO hovers around 0.8 USD price, valuing the protocol at around $450 current market cap with a current circulating supply of about 540 million tokens. Users can buy OSMO on various centralized and decentralized exchanges.

Overview of Osmosis Crypto and its Features

Unlike DEXs on the Ethereum network, Osmosis runs its own blockchain based on the Cosmos SDK, which allows it to operate across chains. In addition, Osmosis stands out in the crowded decentralized exchange market thanks to its unparalleled level of customization. Unlike other protocols that limit themselves to basic token swapping, Osmosis takes things to the next level with a wide range of advanced features. These include dynamic fee swaps, multi-token liquidity pools, and bonding curves, among others. As a result, developers can create and deploy their own fully customizable automated market maker (AMM) with unique parameters that can be seamlessly integrated into the broader IBC ecosystem and beyond.

Osmosis today has over $160 million in TVL (Total Value Locked) across all liquidity pools, more than $8M in daily trading volume, and more than 1,000 interchain transfers.

The issue of volatile liquidity is a common challenge faced by all decentralized exchanges (DEXs). Since users tend to gravitate towards liquidity pools that offer the highest rewards, the liquidity in the AMM space is often unstable and unpredictable. However, Osmosis has found a unique solution to this problem. Unlike other DEXs, Osmosis allows users to create their own liquidity pools with customizable parameters. This provides greater flexibility and control over the liquidity supply, reducing the market’s volatility. In addition, liquidity providers can use Osmosis’ native token, OSMO, to vote on changes to the composition of specific pools. This ensures that the liquidity remains balanced and stable, allowing traders to make more informed investment decisions.

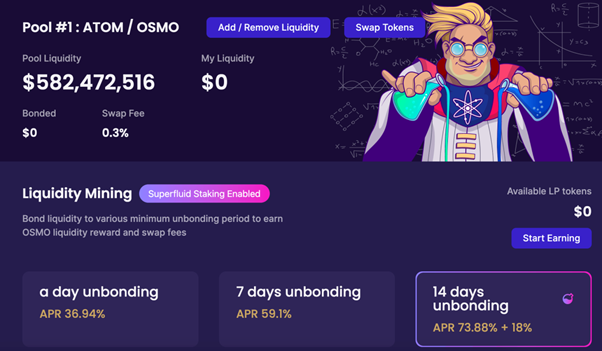

Osmosis uses a unique staking process called superfluid staking. This process lets users simultaneously provide liquidity to a pool while staking their assets to secure the network.

What this means is that when users deposit any two Osmosis-supported tokens into a liquidity pool, they automatically stake their liquidity shares on both tokens’ chains. By doing so, they become eligible to earn a share of transaction fees for providing liquidity to the Osmosis automated market maker (AMM) and rewards for securing the chain of the token they are staking.

Superfluid liquidity pools allow liquidity providers on Osmosis to participate in liquidity pools simultaneously and also stake their LP tokens to validators on the blockchain.

Superfluid liquidity pools allow liquidity providers on Osmosis to participate in liquidity pools simultaneously and also stake their LP tokens to validators on the blockchain.

In April 2022, Osmosis launched Osmosis Frontier, a platform for “DeFi degens” that prioritizes full permissionless listing and curation of assets over user experience. The purpose of Frontier is to combine Osmosis’ commitments to permissionless listing and superior user experience by curating the primary front-end for optimal user experience while allowing assets to appear permissionless on Frontier. It is advised to be cautious as the pools may be shallow, impacting the price. Assets not approved for incentives by the DAO will not earn LP rewards.

Osmosis Frontier is a freer version, allowing you to trade and farm a wider variety of tokens.

Osmosis Frontier is a freer version, allowing you to trade and farm a wider variety of tokens.

Getting Started with Osmosis Crypto

Getting started with Osmosis Crypto is easy. Users can connect an eligible wallet like XDEFI Wallet on the platform and access the exchange to trade and stake their assets. The platform supports various assets, including Osmosis Crypto’s native token, OSMO, and other popular cryptocurrencies like Bitcoin and Ethereum. Users can also stake their assets in liquidity pools to earn rewards.

Using Osmosis Crypto for Trading and Staking

To trade on Osmosis Crypto, users can select the trading pair they wish to trade, enter the amount they want to trade, and confirm the transaction. Users can also provide liquidity to pools by depositing their assets into a pool and receiving LP tokens in return. These LP tokens can then be staked to earn rewards. Osmosis Crypto offers various trading pairs and liquidity pools, offering users plenty of options to diversify their portfolios.

One of the unique features of Osmosis Crypto is its emphasis on community governance. The platform has a decentralized governance model, meaning token holders have a say in the decision-making process. Token holders can participate in governance voting to help shape the direction of the platform. This is a significant departure from traditional centralized exchanges, where decision-making is in the hands of a few individuals.

The decision-making process on Osmosis Crypto is heavily influenced by community governance.

The decision-making process on Osmosis Crypto is heavily influenced by community governance.

Maximizing Your Rewards from Osmosis Crypto

To maximize their rewards from using Osmosis Crypto, investors can participate in liquidity pool incentives and governance voting. Liquidity providers can earn rewards by contributing to liquidity pools. Especially Omosis’ superfluid liquidity pools are worth mentioning when maximizing rewards. Governance voting allows token holders to have a say in the direction of the platform.

However, it’s important to note that investing in cryptocurrencies is not without risks. The risks of using Osmosis Crypto include market volatility, regulatory uncertainty, and technical vulnerabilities. The value of cryptocurrencies, including OSMO, can fluctuate rapidly and unpredictably. This means that users could potentially lose a significant portion of their investment if they are not careful. Investors should also be aware of the tax implications of using the platform, as cryptocurrency transactions are subject to taxation in many jurisdictions.

Furthermore, like any other software system, Osmosis Crypto is vulnerable to technical issues and hacking attempts. While the developers of Osmosis Crypto have implemented numerous security measures to protect the platform and its users, there is always a risk of technical vulnerabilities that malicious actors could exploit. Users should be aware of the potential risks and take appropriate measures to protect their investments.

Conclusion

Osmosis Crypto is a decentralized exchange that provides investors a secure and flexible way to trade and stake their assets. With its low fees, multi-token liquidity pools, and automated market maker algorithm, Osmosis Crypto is an attractive option for traders looking to diversify their portfolios. However, investors should always exercise caution and do their due diligence before investing in cryptocurrencies.

Users of Osmosis Crypto should be aware of the potential risks associated with using the platform and take appropriate precautions to protect their investments. By participating in liquidity pool incentives and governance voting, users can maximize their rewards from using Osmosis Crypto while also helping to shape the direction of the platform. Overall, Osmosis Crypto represents an exciting opportunity for investors looking to participate in the growing DeFi market.

In summary, Osmosis Crypto is a promising platform with a unique set of features that can benefit both traders and investors. By understanding its workings and potential risks, users can make informed decisions about investing in Osmosis Crypto. With its growing popularity and the increasing interest in DeFi platforms, Osmosis Crypto is worth watching for cryptocurrency enthusiasts.